There is no doubt that Ethereum is one of the most well-known blockchains in the world. The platform has a wide range of use cases, including in the DeFi space with lending and DEX, and with NFTs in gaming and the metaverse.One thing you might have missed about Ethereum, however, is that it is also valuable in enterprise usage. Specifically, the demands for cross-chain transactions between Ethereum and other blockchains have been soaring.This article will explain the background and use cases of the evolving needs of cross-chain transactions between Ethereum and other blockchains.

Background

As mentioned in the introduction, demonstration tests of cross-chain transactions using Ethereum are underway worldwide. That demonstration assumes Delivery versus Payment (DvP) and Payment versus Payment (PvP) settlements between Ethereum and other blockchains.

There are three main reasons behind this:

The increasing volume of ERC20-compatible stablecoins in circulation on Ethereum

The ongoing implementation of Central Bank Digital Currencies (CBDCs) using enterprise Ethereum such as Hyperledger Besu

The commercialization of enterprise blockchains

In the following parts, I will briefly explain each of these points.

1) The Increasing Volume of ERC20-compatible Stablecoins in Circulation on Ethereum

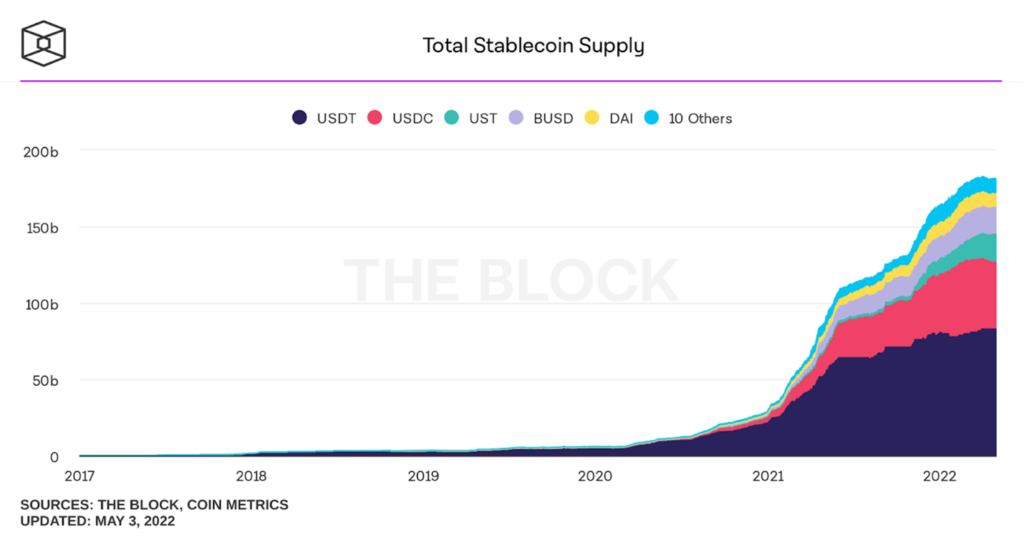

As you know, the amount of stablecoins in circulation is increasing every day. Many of them are ERC20 compatible and can be handled on Ethereum.

Source: https://www.theblockcrypto.com/data/decentralized-finance/stablecoins

Here is a graph from THE BLOCK showing the transition in the supply of stablecoins. As this graph shows, the supply of stablecoins has been increasing rapidly since 2021. In addition, since USDT and USDC are not only stable in price, but are also tokens backed by USD, enterprise companies can use them for settlement with confidence.

2) The Ongoing Implementation of CBDCs using Enterprise Ethereum such as Hyperledger Besu

In addition to stablecoin, countries worldwide are also accelerating their CBDC activities: according to CBDC Tracker, as of April 2022, two countries have launched, 15 countries are in the pilot, 16 countries are in Proof of Concept, and 63 countries are in research. In other words, more than 30 countries worldwide are in the Proof of Concept phase or later.

In addition, a number of countries –including Thailand, Spain and Australia — and the European Central Bank, are considering Hyperledger Besu, the enterprise Ethereum client, as the blockchain foundation for their CBDCs. CBDCs could be one of the new use cases for enterprise Ethereum.

3)The Commercialization of Enterprise Blockchains

While public chain use cases such as DeFi and NFT games have been rapidly gaining popularity in recent years, enterprise use of blockchain is also underway behind the scenes.

For example, in international trade, services such as Contour, we.trade, komgo, and TradeWaltz are already in the practical application phase. In securities, financial companies worldwide have already started tokenizing assets using platforms such as Securitize.

Soaring Needs for Cross-chain Transactions

The three events described above will create the following business needs:

Settlement of transfers of assets on the enterprise blockchain using stablecoins on Ethereum (DVP settlement)

Concurrent exchange of currencies between stablecoins on Ethereum and CBDCs (PVP settlement)

To realize those business needs, we must connect Ethereum and other heterogeneous blockchains and simultaneously execute transactions on both chains.

Use Cases

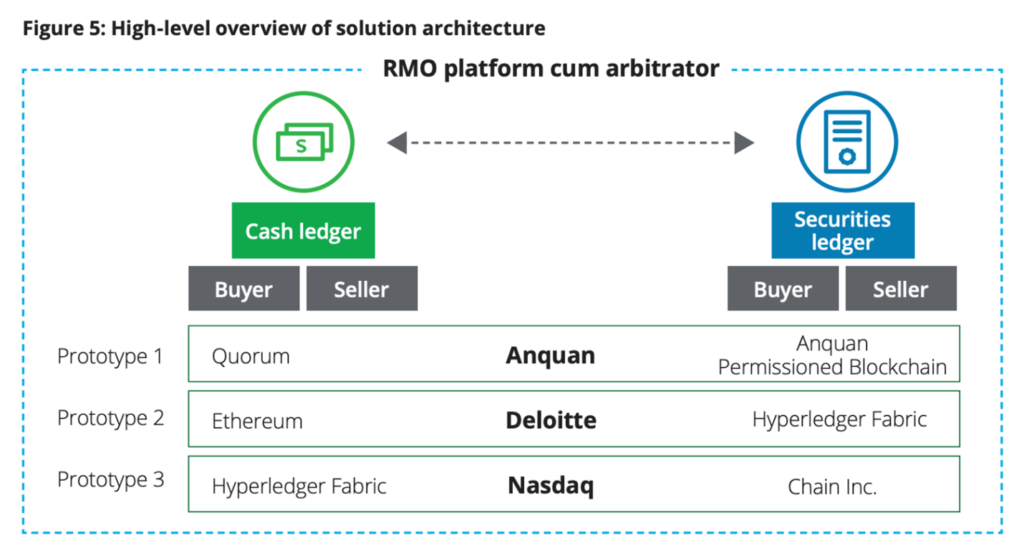

Some companies have already completed proof of concepts that execute DvP settlements between Ethereum and other blockchains. For example, in Singapore’s collaborative CBDC project called “Project Ubin,” The Monetary Authority of Singapore (MAS) has led the creation of a prototype of DvP settlement between Ethereum and Hyperledger Fabric.

Source: Delivery versus Payment on Distributed Ledger Technologies | Project Ubin

In Project Ubin, MAS assumed “Cash ledger” and “Securities ledger” as described above. To execute secure settlements, cross-chain transactions between Cash ledger and Securities ledger are essential.

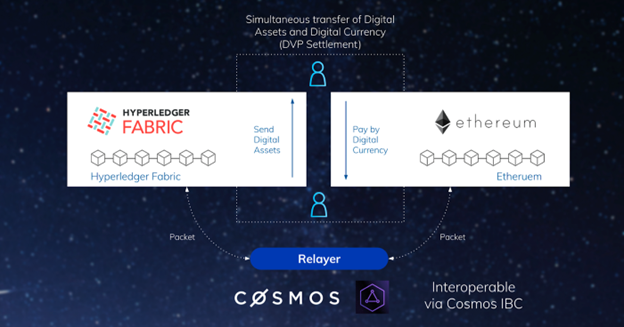

Source: Datachain and NTT DATA Successfully Verified a Bridge Between Ethereum and Hyperledger Fabric using Cosmos IBC

To give another example, Datachain and NTT DATA have completed a proof of concept that validated DvP settlements between Ethereum and Hyperledger Fabric as well.

Datachain and NTT DATA assumed international trades as a primary use case in this joint experiment. In international trades, exporters send B/L (Bill of Lading) to importers to transfer the rights of the trade assets.

In this case, Datachain and NTT DATA chose digital assets on the Hyperledger Fabric and digital currencies on Ethereum (ERC20 tokens such as USDC) to validate whether they can transfer value without the risk of loss through DvP settlement.

Technically, They used Hyperledger Lab YUI, a blockchain interoperability solution project using Cosmos IBC as a communication protocol to enable trustless interoperability, and Cross Framework, which enables cross-chain transactions.

Based on the results, Datachain provided the interoperability technology for a new trade settlement experiment jointly conducted by Tokio Marine & Nichido Fire Insurance, STANDAGE, TradeWaltz and NTT DATA.

Reference: Demonstration Experiment for the Realization of a New Trade Settlement System (January 12, 2022)

https://www.nttdata.com/global/en/media/press-release/2022/january/tokio-marine-and-nichido-ntt-data-standage-and-tradewaltz-jointly-conducted

You can see more types of cross-chain transactions in the paper by the EEA Crosschain Working Group. Although published in 2020, the use cases in the paper remain relevant today.

https://entethalliance.org/wp-content/uploads/2020/08/CIFT_Use_Case.pdf

Datachain is one of the members of the EEA Crosschain Interoperability Working Group. We will continue to contribute to standardizing cross-chain communications.

Conclusion

As those examples above illustrate, the demands for cross-chain transactions between Ethereum and other blockchains have been soaring in the enterprise space. As stablecoins become popular and enterprise blockchain use cases are widely used, connecting Ethereum and enterprise blockchains becomes even more essential.

Also, in the next three to five years, CBDCs in each country will be put into practical use, which makes PvP settlements between CBDC and stablecoin more critical than ever. That will be one of the significant cross-chain transaction use cases using public Ethereum and enterprise Ethereum clients such as Hyperledger Besu.

Learn more about becoming an EEA Member and be sure to follow us on Twitter, LinkedIn and Facebook for all the latest.