A historical signal for Ethereum.

On July 16th, the Enterprise Ethereum Alliance (EEA), joined a delegation led by ERC-3643 Association and with The Linux Foundation and Chainlink Labs, Etherealize to present to the U.S. Securities and Exchange Commission’s (SEC) crypto asset task force. For the first time, Ethereum’s standards and infrastructure were formally showcased inside the halls of the SEC. (read the official SEC meeting statement)

At the same time, the SEC issued a no-action letter clarifying that tokenized securities can be issued on Ethereum under existing laws, without requiring a new legal framework. For enterprises building onchain, this is the kind of clarity they have been waiting for.

This meeting took place during the Crypto Week in DC where the Genius and Clarity act were formally signed, a truly historical moment.

Why This Matters

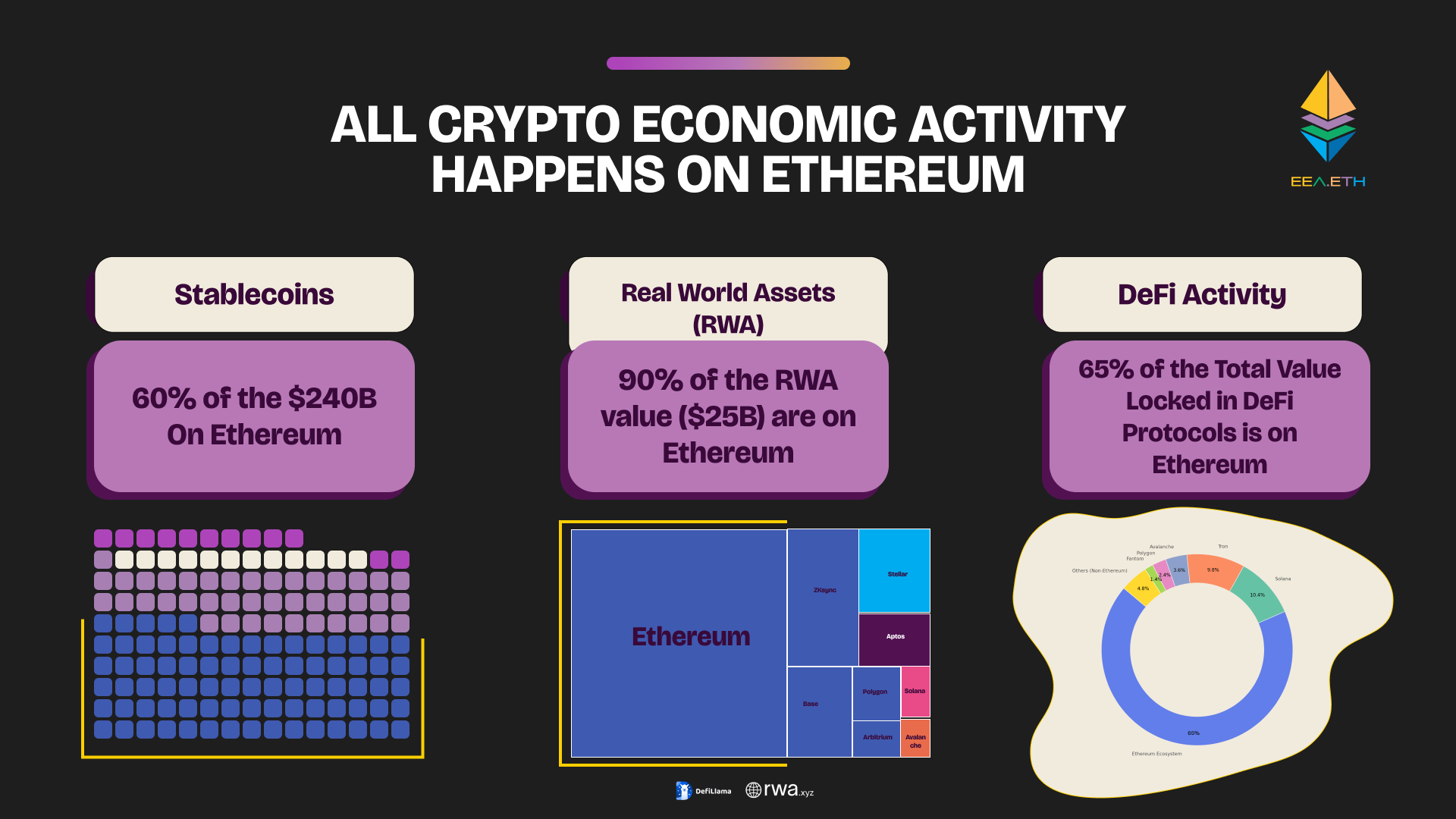

As EEA’s Executive Director, Redwan Meslem, told the task force, Ethereum does not spend millions on billboards. It powers the global crypto economy. Ethereum is the standard.

The SEC’s position affirms what our community has worked on for years: public Ethereum infrastructure can meet regulatory requirements when paired with the right frameworks and controls. This is a major step in aligning regulated markets with open infrastructure.

The EEA’s Role

For nearly a decade, the EEA has been building the connective tissue between enterprises, protocols, and regulators. Our members, from banks and custodians to infrastructure providers and standards bodies, have collaborated on compliance frameworks, technical specifications, and real-world pilots.

That groundwork made this moment possible. The SEC discussion did not just spotlight Ethereum’s technology. It also highlighted the standards and frameworks the EEA has advanced alongside our ecosystem partners.

What’s Next

The EEA will continue to lead the bridge-building:

- Convening working groups on tokenization and regulatory frameworks

- Advancing open standards like ERC-3643

- Creating the platforms for enterprise and policy alignment

We remain committed to ensuring that public Ethereum infrastructure scales into the compliant, secure, and open financial markets of the future.

Huge thanks to our members and collaborators including Dennis O’Connell, Taylor Lindman, Paul Salama-Caro, Ben Sherwin, Vivek Raman, Luc Falempin, Adam Minehardt, Karen Ottoni, and many more for pushing this work forward.

Read More on Cointelegraph.