By Andreas Freund, EEA Mainnet Interest Group Member

The following is a current state of the Ethereum scalability ecosystem mini report, which is longer and more in depth than a typical blog post.

Many enterprises have abandoned private Blockchain consortia due to several factors: the absence of meaningful network effects in private Blockchain implementations – which tend to make them more expensive and cumbersome to manage within a consortium of competing entities than a shared database system – as well as the lack of accessibility of the DeFi ecosystem with its new and rapidly growing, and, therefore, very profitable asset classes. Ethereum Layer 2 (L2) scalability solutions offer an opportunity to fit the square peg of Ethereum Mainnet into the round hole of enterprise security, privacy, and compliance requirements since many L2 solutions are de facto centralized databases with clever cryptography. They can also provide access to the world of DeFi asset classes, allowing Mainnet network effects to spill over to enterprise solutions through those DeFi asset classes. This makes for a new, and symbiotic, relationship between enterprise use cases on L2 and the Ethereum Mainnet through both asset and user growth.

A Brief Introduction to Layer 2 and other Scalability Solutions for Ethereum

The Ethereum Mainnet has become a victim of its own success in that it currently serves as a significant bottleneck for the growth of its ecosystem; network issues have arisen due to high transaction fees and the limited number of transactions allowed per block, endangering the economic viability of Ethereum-based protocols, start-ups, and others with sound business models. While Eth2, the next version of Ethereum, promises a 100x increase in transaction scalability and significantly reduced transaction fees, its rollout is still 12 months or more away. Ethereum scalability challenges need to be addressed today if Ethereum wants to retain its leadership position as the most popular, and most used blockchain network in the world.

Over the last 2 – 3 years several types of solutions have emerged that address the scaling and transaction cost challenges. What they have in common is that all perform the heavy transaction processing off the Ethereum Mainnet (i.e off-chain) in various forms of centralized or decentralized computing environments, while Mainnet is used as the security and data integrity anchor in various forms. These solutions are what is colloquially called Layer 2 (L2) because they are solutions sitting above the Ethereum Mainnet, also often referred to as Layer 1.

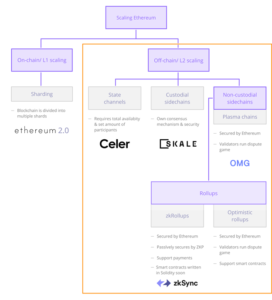

Below is a brief overview of the major scalability solution categories followed by a brief description of the characteristics of each solution category:

- State Channels

- Sidechains

- Rollups

- Optimistic Rollups

- Zero-Knowledge (zk) Rollups

- Plasma

- Validium

Figure 1: L2 Categorizations; Source: Token Terminal

State Channels

State channels scale the Ethereum Mainnet by performing transactions off-chain via secure channels established between parties. They require a user to deposit a snapshot of the latest Ethereum state that the user controls into a multi-signature smart contract; this is analogous to user deposits into payment channels on Bitcoin’s Lightning Network. This snapshot will contain important data such as the ETH holdings of an Ethereum address at a given time.

State Channels allow for (nearly) free off-chain transactions with instant transaction finality and superior privacy because only the state channel operator and participants in the state channel have visibility into the off-chain transactions. Think of a chess game where players place an ante to start the game. This transaction would be recorded on-chain and opens a channel. Individual moves would be signed by each player within the channel. The game would continue until a player leaves or the game ends, at which point one of the players or the game itself would appeal to Mainnet for a ruling and payout of the winnings.

State channels are likely to serve in situations where there are high traffic peer-to-peer multi-directional transactions among reasonably trusted parties. Individual state changes will take place within these channels via signed and secure transactions, with the Mainnet or L2 consensus-based contracts serving to handle periodic and/or “end-game” reconciliation.

Sidechains

Sidechains are blockchains independent of the Ethereum Mainnet with their own consensus models, e.g., Proof of Authority (PoA), Proof of Stake (PoS), and state machine mechanisms such as the Ethereum Virtual Machine or other architectures. Ethereum transactions can be offloaded to such a chain in a custodial manner, decreasing the burden on the Ethereum Mainnet. Depending on the network approach with respect to chains (independent multi-chain vs shared chains), transaction privacy can possibly be preserved via gated access to a chain.

The particular approach each network takes must be evaluated on its own to determine suitability with respect to scalability, security, and fitness for purpose. Some ecosystem participants do not consider sidechains to be true L2 solutions as they neither inherit sufficient security assurances of Ethereum Mainnet due to a lack of onchain transaction data nor provide the ability to arbitrate disputes on the Ethereum Mainnet. Proponents of Eth-connected chain-based networks will argue that their Proof of Stake consensus models and validator models are as rigorous as Eth2 (which also uses a Proof of Stake model) and that their operational ties with Ethereum (in the form of network contracts running on Ethereum) provide sufficient security and transparency in an Eth-native form.

We will outline various chain-based approaches below when we survey the scalability landscape.

Rollups

Rollups are similar to advanced, non-custodial sidechains that achieve high transaction throughput while inheriting the security assurances of the Ethereum Mainnet. Rollups typically fall into one of four main categories: Optimistic rollups, zk-Rollups, Plasma, and Validium.

Rollups are solutions that perform transaction execution outside the main Ethereum chain, but post transaction data on Layer 1. As transaction data is on Layer 1, this allows rollups to be secured by Layer 1. Inheriting most security properties of Layer 1, while performing execution outside of Layer 1, is a defining characteristic of rollups.

Three simplified properties of rollups are

- Transaction execution outside Layer 1

- Data or proof of transactions is on Layer 1

- A rollup smart contract in Layer 1 that can enforce correct transaction execution on layer 2 by using the transaction data on Layer 1

Some rollups require “operators” to stake a bond in the rollup contract. This incentivizes operators to verify and execute transactions correctly. (Layer 2 Rollups, Ethereum.org, https://ethereum.org/nb/developers/docs/scaling/layer-2-rollups/)

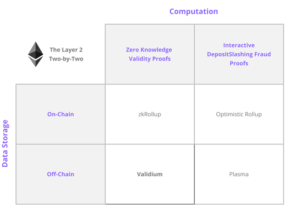

However, “Operators” have the power to censor transactions, if the operator-model is not sufficiently decentralized as Mainnet is. The figure below organizes those categories depending on whether they handle data storage on-chain or off-chain, and whether computational correctness is enforced through zero-knowledge validity proofs or user-deposit-slashing fraud proofs.

Figure 2: L2 Rollup Categories; Source: buildblockchain.tech

Another differentiation between rollup solutions is with respect to where computation takes place and when finality occurs. For example, the computation for ZK Validity Proofs takes place via a third-party operator (or validator, or sequencer) whose primary function is to bundle transactions and submit batches of transactions to the Mainnet. These batches contain minimal but sufficient information to prove the validity of the transactions. The computation of the transactions is handled prior to submission to L1 and finality occurs once validated by the L1 (or after the passage of sufficient L1 blocks as the rollup might dictate).

Optimistic Rollups also compute the transactions off-chain as zk-rollups but not in zero-knowledge and they rely on a contest procedure and contest period within which to abrogate to the Mainnet the decision as to whether a contested transaction is valid or not. As with ZK Validity Proofs, operators of Optimistic Rollups are likely to stake or be bonded such that if an operator submits a fraudulent transaction to the main Ethereum chain, their stake is slashed.

Note that Rollups commonly do not offer privacy to their users. However, new solutions are emerging, both Optimistic (zk Optimistic) and zk Rollups (zk-zk Rollup), that do preserve the privacy of their users. These solutions will be discussed in the next section. Also, note that zk-Optimistic Rollups have worse performance characteristics than Optimistic Rollups because each transaction in the rollup block is much larger than in the case of Optimistic Rollups, and Ethereum blocks are space-constrained through the block gas limit; a trade-off between privacy and performance. On the other hand, zk-zk Rollups have similar performance characteristics as zk Rollups because of a clever usage of cryptography that allows the use of recursive zk proofs which avoids adding more data to a rollup block. Further optimizations in the utilized cryptography avoid an increase in the compute performance requirements compared to zk Rollups.

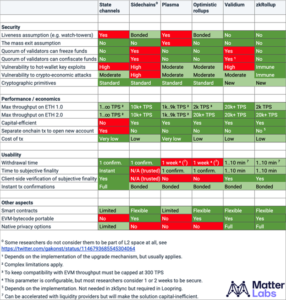

The above L2 solutions have specific performance, security, economic, and usability characteristic which are summarized in the table below:

Figure 3: L2 Solution Characteristics by L2 and Scalability Solution Category;

Source: Matter Labs

Given the rapid changes and optimizations of the employed technologies, the above assessment of the different categories is merely a snapshot in time and could – and is expected to – change substantially over the next 12 to 24 months.

Ethereum Layer 2 and Scalability Solutions Landscape

As already stated, the Ethereum L2 ecosystem is evolving at warp speed — from the Plasma Whitepaper in 2017 to Ethereum’s largest decentralized exchange, Uniswap, going live on an L2 solution in 2021. Hence, any overview of the ecosystem will be both incomplete and quickly outdated. However, a current snapshot is still useful to understand the great variety of projects in the space, and their intended use cases.

We will discuss each category and give one or more examples in more detail and mention additional, notable projects in the same category with links to their websites or Github repositories if they exist.

State Channels

Connext: Connext is a state channels project that has designs on being an L2 solution not only for Ethereum but also a cross-chain routing hub for Ethereum’s many L2 solutions. The project is attempting to address a concern in the Ethereum community that Eth-based L2 projects will not be sufficiently interoperable. Connext’s new cross-L2 transfer system could prove important to ensure that interconnectivity between solutions will be readily available, avoiding network lock-in within any one scalability solution.

Other notable projects are the Raiden Network, Celer, and Perun.

Sidechains

xDai Chain: xDai Chain is an EVM-based sidechain designed to stably facilitate larger transaction volumes; currently at about 70 transactions per second (TPS). The project is built around its STAKE token, which consensus providers stake to economically secure the sidechain. Because of its efficiency, xDai Chain has been recently growing in popularity.

POA Network: Similar to xDai Chain at ~ 70 TPS, the POA Network is an EVM-based sidechain that relies on a set of trusted consensus providers to process transactions quickly and cheaply. The solution seems to be usable for almost any use case from blockchain games to community currencies.

Polygon PoS: Polygon is a technology framework and protocol that enables developers to deploy and connect through a messaging protocol different types of networks — EVM-based Proof-of-Stake chains, Plasma chains, etc. — with each other and Ethereum. Therefore, the aim is similar to Connext, or non-Ethereum based frameworks such as Cosmos. Polygon PoS is Polygon’s sidechain solution. The Polygon token is used as a staking token on the different networks that are deployed in the Polygon network of chains to economically secure the consensus providers. The approach and architecture are similar to the substrate and parachain approach of Polkadot.

Skale: Skale’s Elastic Blockchain Network is an Ethereum compatible POS sidechain solution that can quickly spin up application-specific sidechain instances. Validators for each sidechain are selected as a random, periodically shuffled subset of the entire SKALE validator pool, which is incentivized by staking a token. Validators are managed and shuffled by an application that runs on Ethereum Mainnet.

Another notable sidechain is the Loom Network.

Optimistic Rollups

Optimism: Optimism is an Optimistic Rollup implementation enabling about 100x reduction in gas utilization that is gaining some early traction among some big DeFi players, such as Synthetix. Optimism has built the OVM, an L2-based EVM such that L1 projects can redeploy their Solidity or Vyper smart contracts on Optimism.

Notable projects migrating to Optimism: Uniswap, Compound, Synthetix

Fuel: Fuel was the first Optimistic Rollup implementation on Ethereum Mainnet, going live on Dec. 31st, 2020. Fuel promises fast and efficient token payments, wanting to become the “Earth’s value exchange layer.”

Arbitrum: Similar to Optimism, Arbitrum, developed by Offchain Labs is an optimistic rollup network with validators economically staked in Ether, capable of processing at about 100x gas reduction. The main difference between Optimism and Arbitrum is that Solidity and Vyper smart contracts will be able to be deployed onto Arbitrum without any modifications because the Arbitrum Virtual Machine is the same as the EVM at the bytecode level.

Notable projects migrating to Arbitrum: Reddit, Uniswap

Cartesi Descartes: Cartesi’s Descartes Rollups is a variant of optimistic rollups with interactive dispute resolution, similar to Truebit. Instead of EVM bytecode, Descartes executes the RISC-V instruction set, which allows it to run a Linux VM.

Other notable Optimistic rollup projects are OMGX from the OMG Network, and Nightfall V3 from Ernst & Young, a privacy-preserving Optimistic Rollup where the rollup transactions are zk-snark proofs to preserve transaction privacy, which leads to reduced TPS due to the size of the proofs.

zk-Rollups

zkSync: zkSync is a zk-Rollup solution from Matter Labs that uses zero-knowledge proofs from zk-snarks to realize both high throughput (~ 300 – 2,000 tps based on the number of transactions in a block) and high security (inheriting Ethereum Mainnet security assurances). Matter Labs is also working on a Validium type solution called zkPorter.

Notable projects on zkSync: Curve, Gitcoin, Balancer, Argent

Loopring: Loopring was the first zk-rollup deployed to Ethereum Mainnet, and has been operating on Ethereum Mainnet for over one year. Loopring’s zk-Rollup solution is currently focused on scaling decentralized exchanges with Automated Market Makers and Order books, and payments. The Loopring Exchange and Loopring Wallet are based on Loopring’s technology. OpenOcean has now also migrated to Loopring.

Aztec: Aztec recently launched zk.money, which allows for fully private Ether/DAI transactions. Zk.money is a zk-zk Rollup which is the next generation of zk Rollups. The Aztec technology allows verifying zk proofs of zk-proofs of private transactions; in other words, recursive zk proofs, on the Ethereum Mainnet. Because of the recursive nature of the zk proofs, the same number of transactions as regular zk Rollups can be placed on the Ethereum Mainnet.

This form of zk Rollup seems to be the most promising approach for many enterprise use cases given their strong privacy requirements.

Other notable zk Rollups are the Hermez Network (recently acquired by Polygon) and zkSwap.

Validium

StarkEx: StarkEx is similar to zk Rollups but uses zk-starks instead of zk-snarks, with the main difference being that the zk proofs are significantly larger than the proofs for zk-snarks, and are therefore both more expensive to deposit and to verify than for zk-snarks. The system can run either as a Validium-type system or a zk-rollup. This dynamic allows the project to have higher throughput capabilities compared to pure zk Rollup systems. Current implementation are using the Validium-type implementation.

Notable projects using StarkEx: dYdX, DeversiFi, Paraswap, Immutable X

Plasma

OMG: The OMG Plasma Network, is similar to OMGX but is built on the Plasma architecture, instead of an Optimistic Rollup.

Polygon: Polygon has also released a version of its Polygon sidechain discussed above as a Plasma chain which can exchange messages with other sidechains and rollups as discussed for the Polygon Proof-of-Stake sidechain.

Another notable Plasma chain is the Leap DAO.

What does this mean for Enterprises?

Enterprises have traditionally not been concerned with public Blockchains because security, privacy, and compliance requirements of Enterprise Use Cases have made public Blockchains not suitable for implementation. However, the outcomes of private Blockchain networks have been mixed to disappointing for several reasons. Chief among them, the absence of meaningful network effects in private Blockchain implementations, which tend to make them more expensive and cumbersome to manage within a consortium of competing entities than a shared database system, and the lack of accessibility of the DeFi ecosystem with its new and rapidly growing, and, therefore, very profitable asset classes from a private Blockchain. The L2 scalability solutions discussed offer an opportunity to not only fit the square peg of Ethereum Mainnet into the round hole of enterprise security, privacy, and compliance requirements since many L2 solutions are defacto centralized databases with clever cryptography but also access the world of DeFi asset classes allowing Mainnet network effects to spill over to enterprise solutions through those DeFi asset classes. This makes for a new, and symbiotic, relationship between enterprise use cases on L2 with the Ethereum Mainnet through both asset and user growth.

In the next installment of this blog series, we will dive deeper into new and exciting enterprise use cases for L2 solutions leveraging Ethereum Mainnet’s security assurances and vibrant ecosystem.

Until then, stay up to date on everything EEA by following us on Twitter, LinkedIn, and Facebook.